- In 2018, the warehouse automation market grew by more than 13% globally to record sales in excess of USD 12.5 billion. Warehouses are experiencing a continuous increase in investment, driven by increasing levels of automation within the warehouse as well as the integration of supply chains.

- Labor comprises 50% to 70% of a company’s warehousing budget. According to Kane is Able, labor comprises the largest portion of a warehouse’s total operating budget, making finding the right people and optimizing warehouse productivity priorities for most warehouses

- The number of private warehouses is growing. According to data from the U.S. Bureau of Labor Statistics, there are 18,182 private warehousing establishments as of 2018, up from 15,203 in 2008.

- Less than one in ten DCs handle only full pallets for outbound shipping. “According to the 2016 Warehouse Operations Survey, only 9% of DCs now handle only full pallets during outbound. Most DCs (46%) now handle a mixture of pallets, cases and split cases. While it still could be time-efficient to deliver pallet orders using traditional labor, it might not be so for cases and split cases. Therefore, many warehouses are turning to case conveyors and robotic picking arms for help. In general, many warehouses found that optimizing piece & case picking gave them the highest ROI,” explains Westernacher Consulting

- More than 10% of U.S. warehouses were already using automated warehousing equipment (such as goods-to-person technology) as of 2016.

- Worldwide sales of warehouse automation technology (robotics, logistics, etc.) reached $1.9 billion in 2016 and are expected to reach a market value of $22.4 billion by the end of 2021.

- In 2016, there were about 40,000 shipments of various warehouse automation technologies worldwide. This is expected to increase to at least 620,000 units annually by 2021.

- Labor costs constitute, on average, 65% of most warehouse facilities’ operating budgets.

- From 2006 to 2016, the average hourly wage of all warehouse/logistics employees rose by 16%

- A typical warehouse with 100 non-supervisory employees cost more than $3.7 million in labor expenses annually as of March 2018.

- In 2016, there were 5 workplace injuries for every 100 full-time workers in the warehouse/storage industry.

- The average size of a warehouse today is more than 180,000 square feet, compared to 127,000 square feet from 2000-06.

- The average size of a warehouse today is more than 180,000 square feet, compared to 127,000 square feet from 2000-06.

- Only 9% of distribution centers and warehouses handle only full pallet orders, compared to 46% that handle a mixture of pallets, cases, split cases, and pieces.

- 2015 saw an 18.5% increase in the number of SKUs handled by the average warehouse or order fulfillment operation.

- According to a survey of warehouse and DC operations, the largest challenges they’re facing include insufficient space (43%), inability to attract qualified employees (39%), outdated storage, picking, and handling equipment (34%), and inadequate information systems support (32%)

- On average, retail inventory is accurate only 63% of the time.

- When operations upgrade their pick/inventory systems from paper-and-pencil to a more integrated form of order processing, they enjoy on average a 25% gain in overall productivity, a 10-20% gain in space use, and 15-30% more efficient use of stock.

- Pick-to-Light systems can improve pick rate productivity by 30-50%

- Pick-to-Light, RFID, and Pick-to-Voice technologies reduce picking error rates by 67% compared to manual paper-and-pen methods.

- Walking and manually picking orders can account for more than 50% of the time associated with picking.

- The average order picker can pick between 60 to 80 picks per hour, compared to a pick rate of up to 300 picks per hour when leveraging sorters and conveyors.

- Robotics and automation technologies have increased labor productivity by about 0.35% annually, which may not sound like much, but is on par with the impact felt by the steam engine from 1850 to 1910.

- Automated Storage and Retrieval Systems (AS/RS) have the potential to increase order accuracy levels to above 99.99%

- More SKUs can be handled with automation solutions. “For 2018, the average number of SKUs in a warehouse reached 13,985, up from 13,130 last year. Additionally, when asked roughly what percentage of SKUs are conveyable or could be handled robotically, respondents’ average answer was 43%, up from 29% last year,” explains Logistics Management

- Warehouses have a high injury rate (about 1 in 20). According to data from the U.S. Bureau of Labor Statistics (BLS), the rate of recordable illness and injury cases in the warehousing and storage sector was 5.1 out of every 100 workers in 2017.

- A typical warehouse spends millions of dollars in labor expenses annually. Westernacher Consulting explains, “A typical warehouse with 100 employees costs more than $3.5 million in labor expenses per year (an average production and nonsupervisory employee earns $15.81 per hour at an average of 42.9 hours per week as of 2016). This is not considering health insurance, seasonal labor spikes and overtime adjustments.”

- Just 10% of warehouses reported using sophisticated warehouse automation technology in 2016. Westernacher Consulting predicts that the percentage of warehouses leveraging sophisticated automation technologies will grow within the next five years.

- Warehouses and distribution centers increasingly leverage robotics for pick and place, parts transfer, pick to cart, order fulfillment, truck loading and transportation. As Logistics Management explains, “For applications, using or considering robotics for pick and place or parts transfer climbed by 8% to reach 41%, while using or considering robotics for palletizing declined by 8%. Use or consideration of robotics for pick to cart, order fulfillment (picker to part), truck loading, and transportation also were on the upswing.”

- Worldwide warehousing and logistics robot shipments are increasing. “Tractica forecasts that worldwide warehousing and logistics robot unit shipments will increase from 40,000 in 2016 to 620,000 units annually by 2021. The market intelligence firm estimates that global market revenue for the sector reached $1.9 billion in 2016 and anticipates that the market will continue to grow rapidly over the next several years, reaching a market value of $22.4 billion by the end of 2021.”

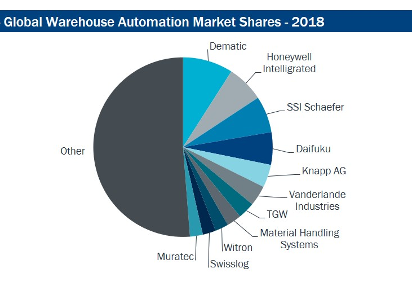

- Fulfillment and Warehouse Automation Industry is very fragmented as shown in the pie chart. The robotic segment of the Fulfillment Automation Industry is even more fragmented with many recent startup companies providing specialty robots like, Kiva (Amazon Robotics), Attabotics, Warehouse Automation and others.

- British grocer Ocado recently announced that it is bolstering its robotics capabilities with the acquisitions of North American companies Kindred Systems and Haddington Dynamics for a total of $287 million.

- After completion of a successful 10% LOFC program the conservative potential for delivery over the following 5 years of fully functional LOFCs is over 100 LOFCs. This represents the sale of between 200,000 and 400,000 ABB robots in that period and will establish ABB/B&R as the preeminent leader in Online Fulfillment Center Automation.

- Since 2011, Amazon has invested over $3 billion in Massachusetts, from building customer fulfillment infrastructure and research facilities. Opening in 2021, the company plans to invest more than $40 million to develop a new state-of-the-art site in Westborough, MA, complete with corporate offices, research and development labs, and manufacturing space. The new 350,000 square feet facility will be in addition to the Amazon Robotics’ current facility in North Reading, MA, and together serve as the company’s epicenter of robotics innovation.

- In March 2012, Amazon acquired Kiva Systems for $775 million. At the time, this was Amazon’s second-largest acquisition in its history. Kiva Systems provides a new approach to automated order fulfillment using a fleet of mobile robotic drive units, moveable shelves, work stations and sophisticated control software for pick, pack, and ship operations.